What You Need to Know About Solar Tax Credits

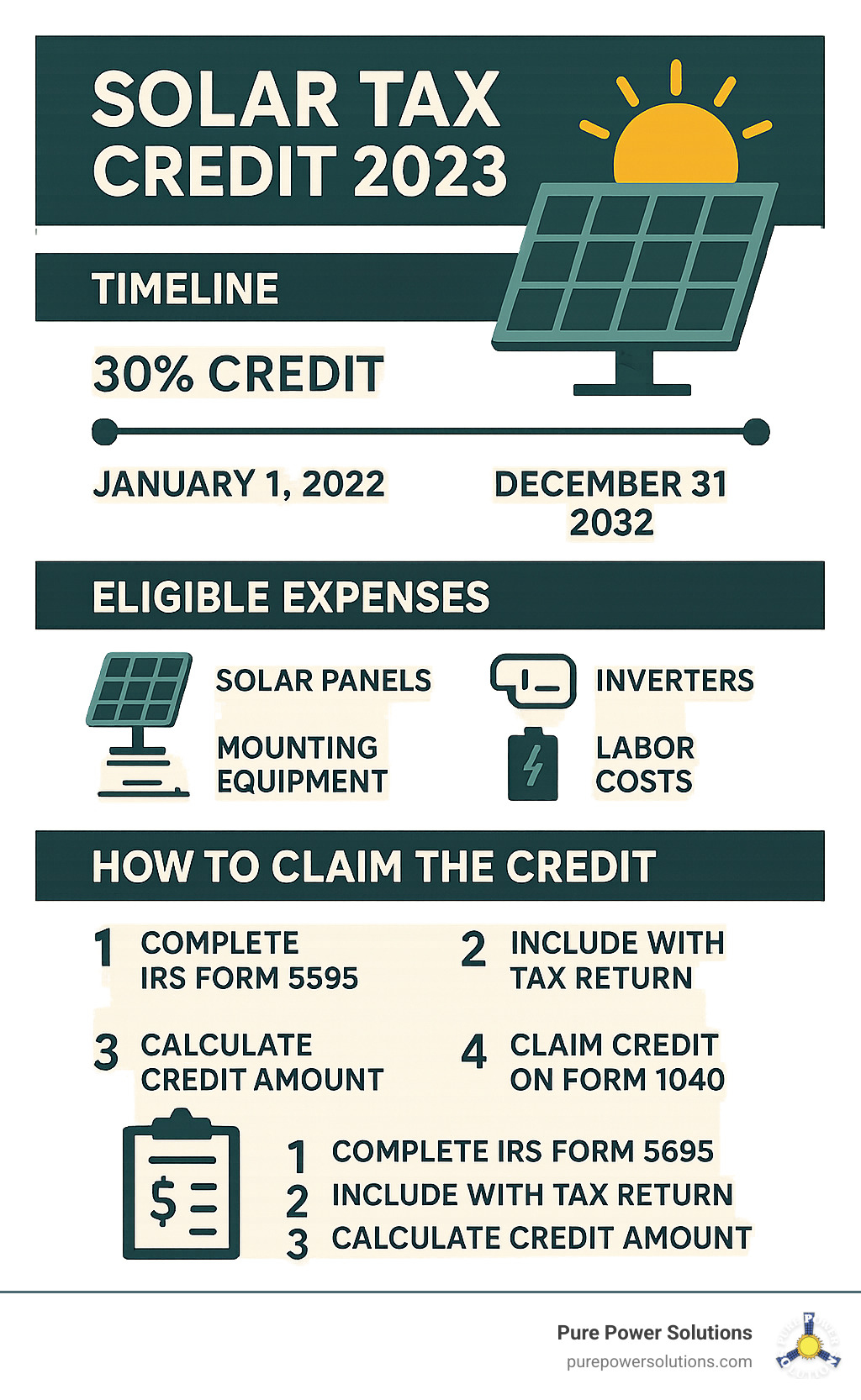

The solar tax credit 2023 provides homeowners with a 30% federal tax credit for installing solar energy systems. This valuable incentive was extended and improved through the Inflation Reduction Act of 2022.

Quick Facts About the Solar Tax Credit 2023:

| Feature | Details |

|---|---|

| Credit Amount | 30% of qualified installation costs |

| Valid Through | December 31, 2032 (then phases down) |

| Eligibility | Residential and commercial installations |

| Qualified Expenses | Solar panels, inverters, mounting equipment, labor costs, battery storage |

| How to Claim | File IRS Form 5695 with your tax return |

The solar tax credit 2023 represents one of the most significant financial incentives available for homeowners looking to transition to clean energy. By reducing your federal income tax liability by 30% of your solar installation costs, this credit makes renewable energy more accessible and affordable than ever before.

This tax credit isn’t just a short-term offer – it’s been extended through 2032, giving homeowners plenty of time to plan their transition to solar power. Whether you’re motivated by environmental concerns, rising utility costs, or energy independence, understanding how to maximize this credit is essential for making an informed decision.

I’m Rody Jonas, owner of Pure Power Solutions in Healdsburg, California, and I’ve helped countless homeowners steer the solar tax credit 2023 to maximize their savings while transitioning to clean energy solutions across Northern California.

Understanding the Solar Tax Credit 2023

The sunshine falling on your roof isn’t just a source of warmth—it’s also money in your pocket, thanks to the solar tax credit 2023. Officially called the Residential Clean Energy Credit, this valuable incentive lets homeowners claim a whopping 30% of their solar installation costs as a credit against their federal income taxes. When we explain this benefit to our Northern California clients, their eyes light up at the substantial savings.

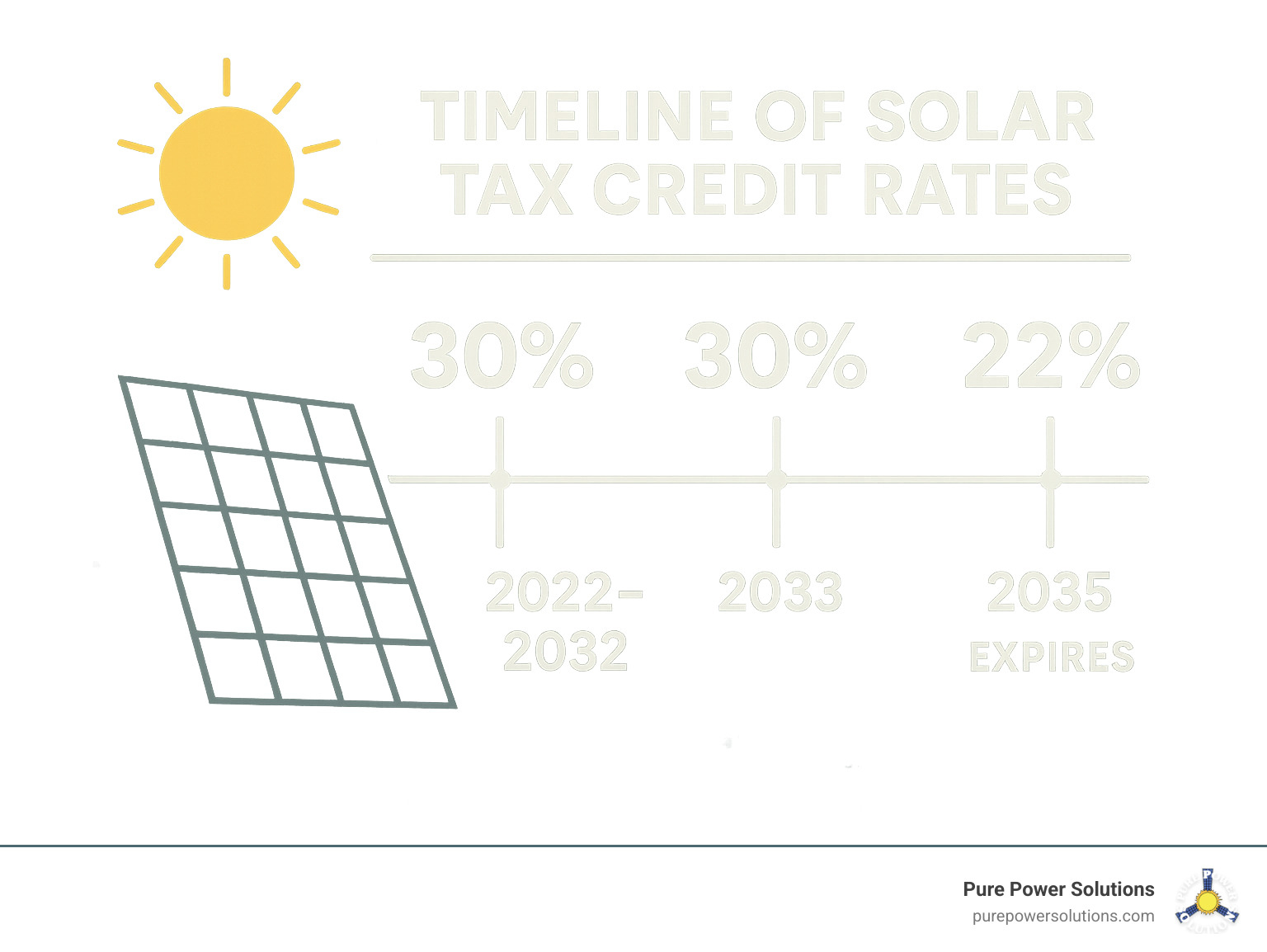

Thanks to the Inflation Reduction Act of 2022, this powerful financial incentive got a major boost and extension. This isn’t a here-today-gone-tomorrow offer—the solar tax credit 2023 applies to systems installed between January 1, 2022, and December 31, 2032. After that, it gradually steps down: 26% in 2033, then 22% in 2034, before sunsetting in 2035 (unless Congress extends it again).

The good news is that eligibility is refreshingly straightforward. You likely qualify if:

- You install a new solar PV system at your primary or secondary U.S. residence

- You own (not lease) your solar PV system

- The system is either brand new or being used for the first time

For more detailed information about the Residential Clean Energy Credit, you can visit the IRS’s official guidance page.

Here at Pure Power Solutions, we’ve guided hundreds of families across Sonoma, Napa, Marin, Mendocino, and Lake County through this process. The joy on homeowners’ faces when they realize how much they’ll save is one of the most rewarding parts of our work. Many clients tell us that understanding this credit was the tipping point that made solar not just environmentally sound, but financially smart too.

How the Solar Tax Credit Works

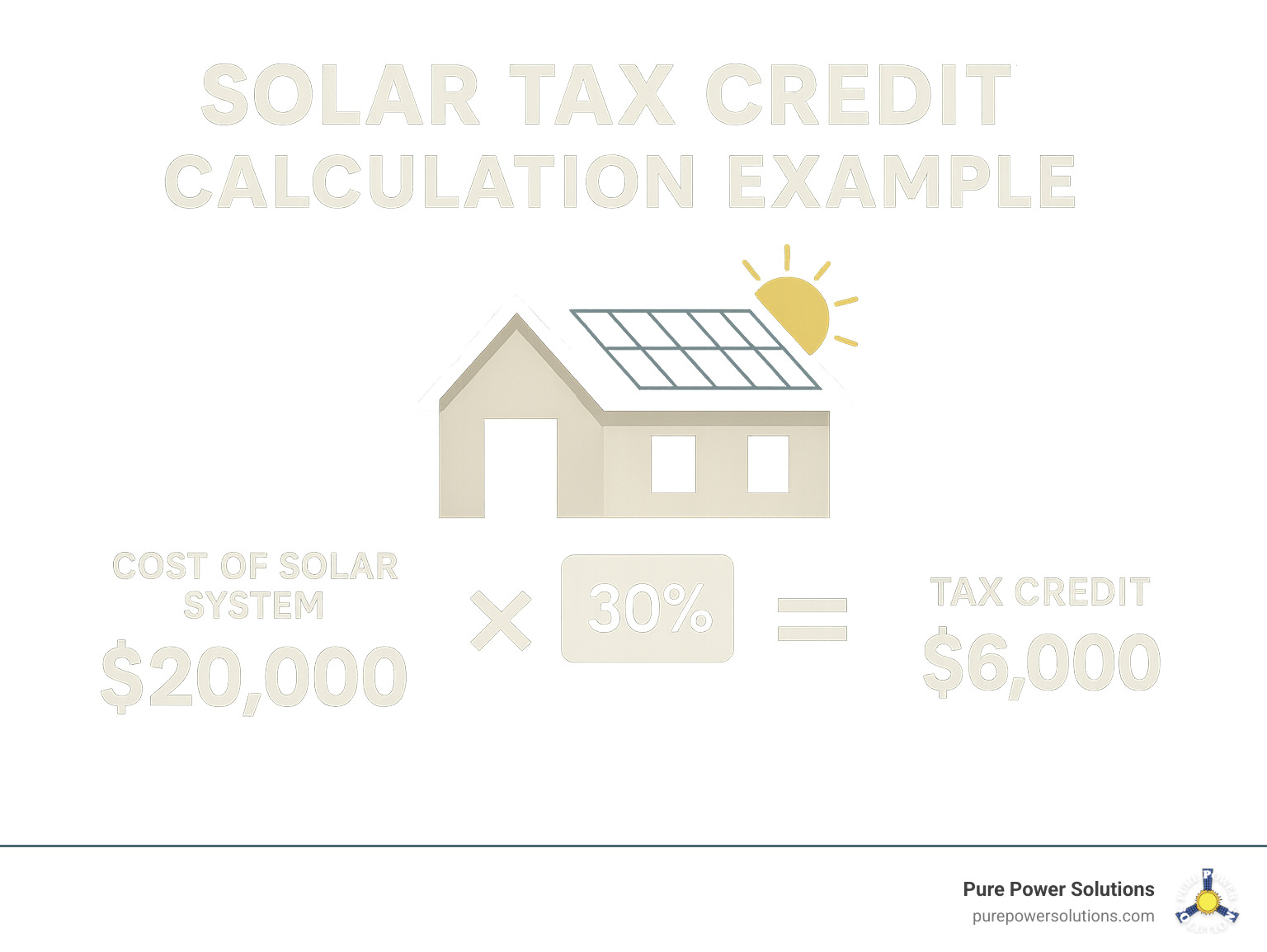

The solar tax credit 2023 is refreshingly straightforward – it directly reduces what you owe in federal taxes, dollar-for-dollar. Think of it as the government essentially paying for 30% of your solar system!

Here’s how it might work for your family: If you install a $20,000 solar system on your Sonoma County home, you’d be eligible for a substantial $6,000 tax credit. If you were going to owe $7,000 in federal taxes this year, applying the credit means you’d only pay $1,000 instead. That’s real money staying in your pocket!

One important detail to understand is that this is a non-refundable tax credit. This means two things:

You can’t receive more in credit than you actually owe in taxes, and if your tax bill is smaller than your credit amount, you can carry the remaining credit forward to future tax years (currently through 2034).

For example, if your tax liability is only $4,000 in the installation year, you’d use that portion of your credit and then roll the remaining $2,000 to next year’s taxes. This flexibility helps ensure you can capture the full benefit, even if you don’t have a large tax bill in a single year.

Your solar tax credit 2023 applies to the comprehensive cost of your solar energy system, including equipment costs, all labor for preparation and installation, plus permitting fees, inspection costs, and developer fees. Many homeowners are surprised by how many expenses actually qualify!

At Pure Power Solutions, we’ve guided countless Northern California families through this process over our 30 years in business. We take pride in helping you identify every eligible expense to maximize your tax credit – just one of the ways we make going solar as rewarding as possible.

Qualified Expenses for the Solar Tax Credit

When it comes to the solar tax credit 2023, knowing exactly what you can include helps you get the biggest tax break possible. I’m happy to tell you that the IRS is pretty generous about what qualifies!

Solar Equipment

Your basic solar system components all count toward the credit. This includes your solar panels (the stars of the show!), inverters that transform the sun’s energy into usable electricity for your home, mounting equipment that secures everything to your roof, and all the wiring and electrical components that tie the system together.

Battery Storage

Here’s some fantastic news – battery storage systems are now explicitly covered by the tax credit. If you’re thinking about adding a battery to your existing solar setup, you can still claim the 30% credit as long as you install it before 2033 and it has a capacity of at least 3 kilowatt-hours.

This is especially valuable for our Northern California clients in Sonoma and Napa counties, where wildfire season often brings power outages. Having a battery backup isn’t just convenient – it’s becoming essential, and now it’s more affordable too!

Labor and Soft Costs

The solar tax credit 2023 doesn’t just cover hardware. All those other expenses add up, and thankfully, they count too! This includes site preparation (getting your property ready for installation), assembly and installation labor (the skilled work of putting your system together), plus all those necessary but sometimes forgotten costs like permitting fees, inspection costs, and developer fees.

System Monitoring Equipment

Don’t forget about the tech that helps you track your system’s performance! Monitoring systems and energy production meters that help you see how much power you’re generating also qualify for the credit.

At Pure Power Solutions, we take pride in designing solar and battery systems that not only maximize your energy production but also take full advantage of these tax incentives. Our 30 years of experience really shines when we’re crafting custom solutions for homes across Northern California – especially for our clients in Mendocino and Lake Counties who need reliable off-grid systems that work when the power grid doesn’t.

Changes and Extensions in the Solar Tax Credit

The solar tax credit 2023 got a remarkable boost thanks to the Inflation Reduction Act (IRA) signed into law in August 2022. This game-changing legislation revitalized what was previously known as the Investment Tax Credit, which had been on a path to extinction. Instead of fading away, the solar tax credit is now stronger than ever!

Key Changes Under the Inflation Reduction Act:

Remember when the credit was dropping to 26%? Well, the IRA bumped it back up to a full 30% for all installations from 2022 through 2032. That’s a whole decade of certainty for homeowners considering the switch to solar energy. As someone who’s helped countless Northern California families make this transition, I can tell you this predictability is invaluable for planning purposes.

Perhaps my favorite improvement is the new treatment of battery storage systems. Now, batteries qualify for the 30% credit even when installed separately from your solar panels. This is huge news for our clients in Sonoma and Napa who might have installed solar years ago but now want to add battery backup due to increasing power outages during fire season.

The IRA also simplified the overall credit structure, making it much more straightforward for the average homeowner to understand and claim. No more navigating complex qualification tiers or confusing phaseout schedules!

Phase-Out Schedule:

The current timeline gives you plenty of breathing room to make your solar decision:

- 30% credit for systems installed from 2022-2032

- 26% credit for systems installed in 2033

- 22% credit for systems installed in 2034

- Credit expires in 2035 (unless Congress extends it again)

This generous timeline means our neighbors in Sonoma, Napa, Marin, Mendocino, and Lake County have ample time to research, budget, and implement solar energy systems while capturing the maximum financial benefit. At Pure Power Solutions, we’re seeing many homeowners who had been on the fence about solar now moving forward with their projects, knowing they have this substantial tax incentive behind them.

Frequently Asked Questions about the Solar Tax Credit 2023

What qualifies for the solar tax credit?

Wondering exactly what you can include when calculating your solar tax credit 2023 benefits? Good news – the credit covers quite a lot!

Your solar panels and photovoltaic cells are covered, of course, along with any solar thermal systems that generate electricity. But many homeowners don’t realize they can also include all those labor costs for getting your site ready, assembling the equipment, and installing everything properly.

Even the paperwork costs count – those permitting fees, inspection costs, and developer fees you might grumble about paying are actually credit-eligible. And with recent changes, battery storage systems (as long as they’re at least 3 kilowatt-hours) are now included too. Don’t forget to add in any sales taxes you paid on these eligible expenses!

To qualify, the system needs to be installed at either your primary home or vacation property in the United States, and you need to own the system outright rather than leasing it. The good news is that both newly constructed homes and existing properties qualify.

How do I claim the solar tax credit?

Claiming your solar tax credit 2023 isn’t as complicated as you might think. Here’s the straightforward process:

First, keep every receipt and document related to your solar installation – this paperwork will be your best friend at tax time! When you’re ready to file, you’ll complete IRS Form 5695 (that’s the Residential Energy Credits form), where you’ll calculate your credit amount. Then simply include that credit figure on your 1040 form and submit both forms with your tax return.

You can download the latest IRS Form 5695 directly from the IRS website along with detailed instructions for completing it correctly.

At Pure Power Solutions, we make this process even easier by providing detailed documentation of all your eligible expenses. While we’re solar experts rather than tax professionals, we ensure you have everything you need when you sit down with your accountant or tax preparer.

Why might I not receive the full solar tax credit?

Sometimes homeowners are surprised when they don’t receive the full 30% credit they were expecting. There are a few common reasons this happens.

The most frequent issue is having insufficient tax liability. Since this is a non-refundable tax credit, you need to owe enough in federal taxes to claim the full amount. If your tax bill is smaller than your credit amount, don’t worry – you can carry the remainder forward to future tax years.

Another common issue involves ineligible expenses. For example, if you needed to replace your roof before installing solar, that roofing cost typically isn’t eligible (unless it’s specifically designed as a solar roof).

Timing matters too. You must claim the credit for the tax year when your system was “placed in service” – that’s when the installation is complete and your system is ready to generate electricity.

Lastly, if you’ve leased your system rather than purchased it, you can’t claim the tax credit yourself. In that case, the leasing company receives the credit instead.

For more information about renewable energy tax credits, the Department of Energy offers a comprehensive homeowner’s guide that addresses many common questions.

If maximizing your tax credit is important to you (and why wouldn’t it be?), we recommend chatting with a tax professional and working with experienced solar installers like our team at Pure Power Solutions. We understand all the nuances of the credit and can help ensure you’re set up for success.

Conclusion

The solar tax credit 2023 offers homeowners across Northern California an exceptional chance to accept clean energy while making it much more affordable. With the 30% credit now secured through 2032, the timing couldn’t be better to consider powering your home with sunshine.

Here at Pure Power Solutions, we’ve been helping folks just like you go solar for three decades. We don’t believe in one-size-fits-all approaches. Instead, we take the time to understand your unique energy situation, design a system custom to your needs, and make sure you get every penny of those tax incentives you deserve.

Our team serves homeowners throughout Sonoma, Napa, Marin, Mendocino, and Lake County with both grid-connected and off-grid solar systems. Many of our clients particularly value our expertise in battery storage solutions, which provide that extra peace of mind during those all-too-familiar power outages we experience in Northern California.

Going solar isn’t just good for the planet—it makes real financial sense too. With electricity rates climbing year after year and these generous tax incentives in place, most solar systems pay for themselves surprisingly quickly while continuing to generate clean, free electricity for decades afterward.

Think about it: lower energy bills, protection from utility rate increases, increased home value, and the satisfaction of producing your own clean energy. Combined with the solar tax credit 2023, these benefits make solar power more accessible than ever before.

Ready to explore how solar could work for your home? Curious about exactly how much the solar tax credit 2023 could save you? Our friendly team at Pure Power Solutions is just a phone call away, ready to provide a no-pressure, personalized consultation that addresses your specific situation and questions.

The sun is shining on solar savings—let’s catch those rays together!